Your desktop and mobile views are connected.

Moving desktop elements between page sections will alter mobile and vice versa.

Hold ‘cmd’ or ‘ctrl’ and then drag an element to a new section to avoid changes.

Moving items within sections won’t affect the other view.

Mobile Tip

Think of your mobile view as a condensed summary of desktop.

A. Expand the content tree to the left

B. Select the visibility icon beside the elements you’d like to show or hide.

Hide elements as needed

All page elements should sit inside the blue page guides. Anything outside is highlighted in red.

Layout Assistant helps you get inside the bounds fast.

Good Job!

A. Navigate to Page Properties

B. Under Layout Assistant, click “Entire Page”. Or select a page section, and apply to a section at a time.

Let’s publish (don’t worry it will only be visible to you).

A. Click ‘Save’,

B. Navigate back to the Page Overview screen

C. Click Publish

The most preferred Buy Now, Pay later provider in the US

Your customers want flexible and convenient payment options—online and in-stores. Afterpay’s buy now, pay later integration for merchants lets you give customers what they need and want. Get started by sharing a few details.

16%

Traffic Increase12%

Sales Uplift13%

New Customer Visits17%

More cart adds Special Report

Special Report

Afterpay leads the way

“Afterpay’s Apple store ranking is consistently higher than competitors Sezzle, Klarna, and Affirm, and has 98% positive reviews on Google Play."1

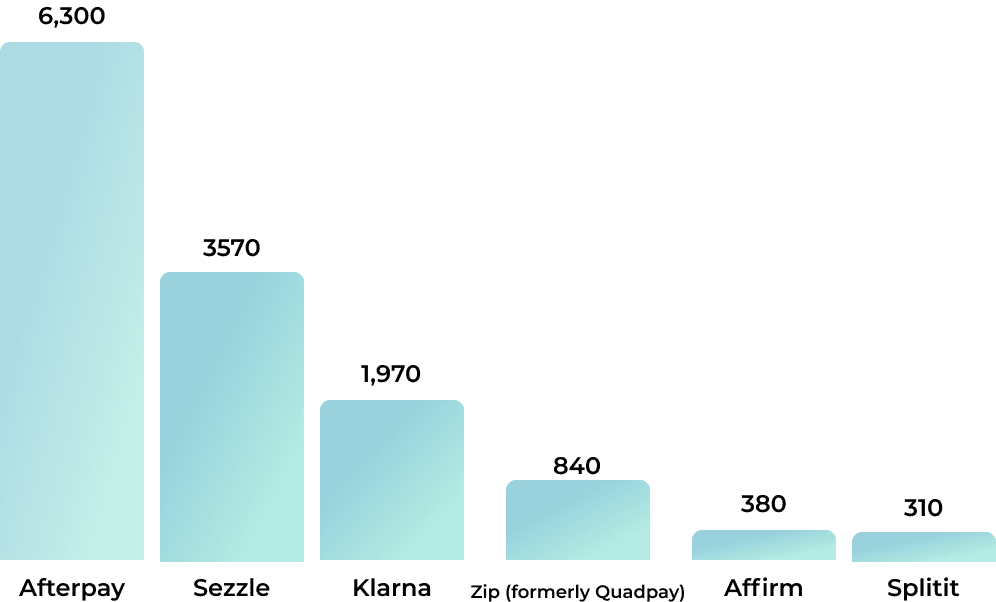

Merchants Listed on BNPL provider store directories

Number of US merchants, as at 1 September 2021

Merchants Listed on BNPL provider store directories

Number of US merchants, as at 1 September 2021

The largest online buy now, pay later marketplace

Afterpay's store directory has more merchants than competitors, Sezzle and Klarna combined.

Number of US merchants, as at 1 September 2021

Number of US merchants, as at 1 September 2021

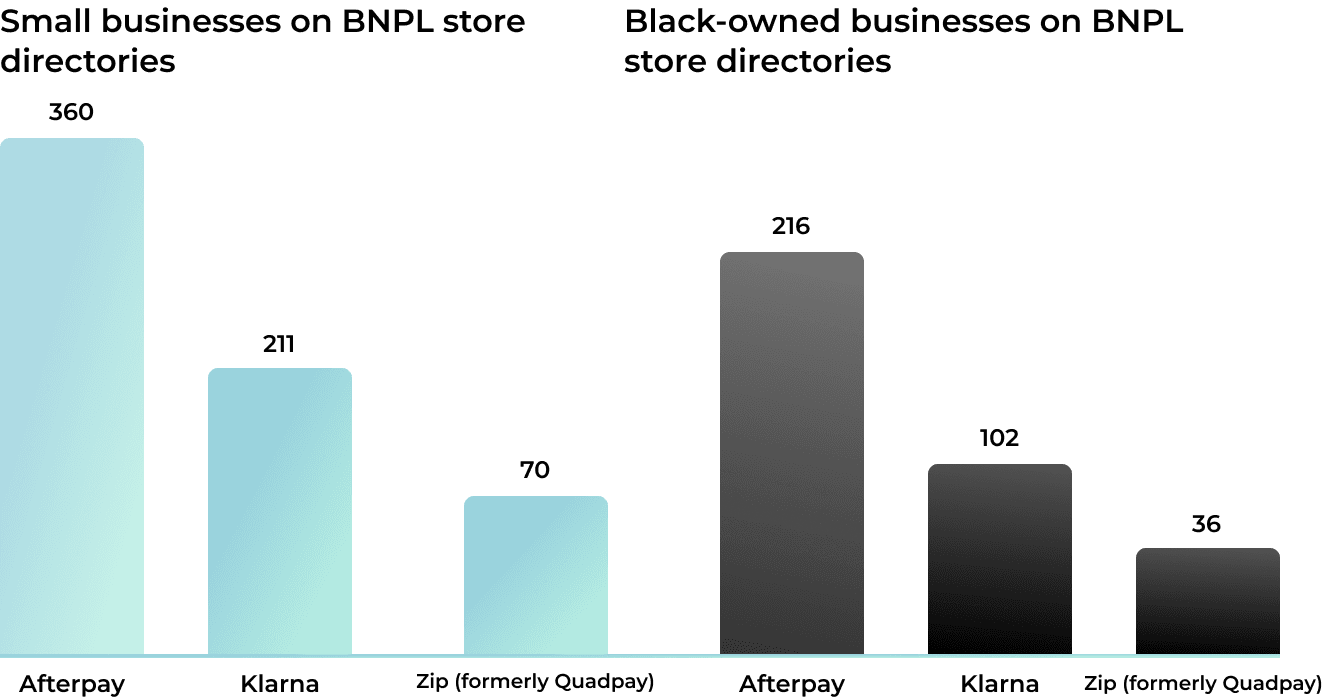

Promoting small businesses and diversity

Afterpay leads in merchant diversity by promoting twice as many small black-owned businesses than competitors, Klarna and Zip (formerly Quadpay)

“By adding Afterpay to our other payment options, we’re able to provide a more customized shopping experience, give our customers additional convenience and control and reach a younger demographic who may not have been able to shop with us before.”

John Strain, Chief Digital Officer, Gap IncSee how Afterpay stacks up with competition

Afterpay vs. Affirm

BNPL shoppers in the United States have chosen to use Afterpay over Affirm more often. A survey among over a thousand BNPL users in the US on the BNPL methods they used in the past year found that consumers used Afterpay 50% more than Affirm. Adding a well-used payment method like Afterpay can help you to increase your store’s transaction volume.

Afterpay offers a simple, straightforward platform solution that allows merchants to market to, convert, and grow their customer base from multiple points within the shopping funnel. With support for features like Express Checkout, subscriptions and recurring payments, intelligent ad formats, a self-service data & insights portal, and an implement-once, deploy everywhere global API, Afterpay can help your business drive incrementality.

Source: US BNPL Industry Performance, August 2021, Accenture

Afterpay vs. Klarna

In the past year, Afterpay was the most searched for BNPL platform in the US. In fact, US consumers searched for Afterpay 53% more than Klarna on average1. According to a survey of BNPL shoppers in the US, consumers used Afterpay 36% more than Klarna in the past year2. Adding the most popular installment payment option in the US can help you to tap into Afterpay’s 19 million active global customer base3, as well as the new customers who join the Afterpay network every day.

Afterpay offers a simple, straightforward platform solution that allows merchants to market to, convert, and grow their customer base from multiple points within the shopping funnel. With support for features like a self-service data & insights portal, omni-channel merchant insights, and an implement-once, deploy everywhere global API, Afterpay can help your business understand and engage your customer.

1. Google Trends, January 2021–January 2022, accessed 1/3/22

2. US BNPL Industry Performance, August 2021, Accenture

3. Block Q4'21 Earnings Call

Afterpay vs. Sezzle

According to a survey of BNPL shoppers in the US, consumers used Afterpay 1.85x more than they did Sezzle in the past year. Higher use with amore popular installment payment option like Afterpay can lead to additional conversions at checkout.

Afterpay offers a simple, straightforward platform solution that allows merchants to market to, convert, and grow their customer base from multiple points within the shopping funnel. With support for features like Express Checkout, an integrated self-service data & insights portal, and an implement-once, deploy everywhere global API, Afterpay can help your business drive incrementality.

Source: US BNPL Industry Performance, August 2021, Accenture

Afterpay vs. Zip (formerly Quadpay)

Afterpay has a customer satisfaction level that’s 40% higher than Zip (formerly Quadpay), meaning that US consumers are more likely to recommend Afterpay to their friends, family, and colleagues than they are to recommend Zip (formerly Quadpay). As a merchant, it’s imperative to allow consumers to pay with their preferred payment method in order to reduce abandonment and drive incrementality.

Afterpay offers a simple, straightforward platform solution that allows merchants to market to, convert, and grow their customer base from multiple points within the shopping funnel. With support for features like Express Checkout, a self-service data & insights portal, and personalized shopper recommendations, Afterpay can help businesses to achieve their growth goals.

Source: US BNPL Industry Performance, August 2021, Accenture

Note: Quadpay is now known as Zip, but was still under the name Quadpay at the time of publication of the cited Accenture report.